Jump to:

Jump to:

FirstHome combo SKIP Slim down your deposit First Home Hub Interest rates Calculators Talk to usFirstHome Combo. Our market-leading package could put thousands back in your pocket.

- A discount off our 12-month fixed interest rate for the first year. Give yourself a headstart with your new home and a discount for the first year. You could spend the savings on making your new home perfect. So many options.

- $2,000 cash back in your hand. Once your home loan is settled, we’ll give you a $2,000 thank you, ready for you to spend on anything you like. Pay day.

- $1,000 toward your new home’s insurance. Insurance is essential, so we’ll contribute $1,000 to your SBS Insurance home policies. That’s a saving.

- $1,000 back into your SBS Wealth KiwiSaver. We’ll even give you $1,000 to put back into your SBS Wealth KiwiSaver account. Uncrack that nest egg.

SKIP to the front of the line.

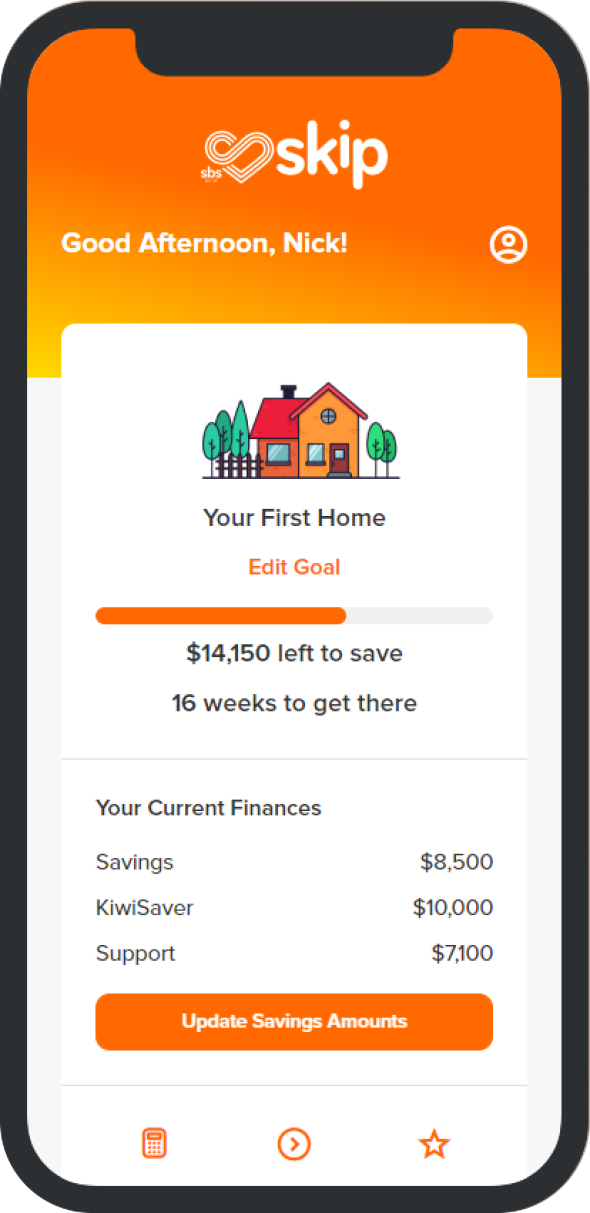

SKIP is our online tool to help First Home Buyers achieve their dreams. It gives you tips and tricks, helps crunch the numbers, and coaches you on saving and house hunting. You can even earn up to $2,000 cash back on your first home loan.

- Find out how much you could borrow. Enter your income and outgoings, and we’ll give you an estimate for potential loan size.

- Track your savings progress. SKIP is like your savings coach. Set your targets and keep them, all the way to your new front door.

- See if you’re eligible for help from Kāinga Ora. Could you be in line for a 5% deposit loan? SKIP can help you find out.

- Earn up to $2,000 SKIP Dollars. Every step you make toward your first home on SKIP earns you more SKIP Dollars. When you finally buy your new home, we deposit those SKIP Dollars into your account, to spend on anything you like.

Could you slim down your deposit?

With our partners at Kāinga Ora we’ve made it easier to get into your first home. You might qualify for a 5% deposit First Home Loan.

5%

Deposit

To approved buyers

It’s all in our First Home Hub.

The first home journey can be like venturing into the wilderness. We’ve put together everything you need to know, without making it overwhelming. Watch short videos about the different stages of buying, read what you need to do, and check our timelines and tools. We’ll be with you every step of the way.

Our best interest rates.

FirstHome Combo

3.99%

per annum

1 year fixed

Apply OnlineAvailable only to first home buyers.

Additional lending fees apply.

Home Loans: Specific lending, account and eligibility criteria and Standard Contract Terms along with Credit Fees and Charges apply. These rates are only available for Residential Home Loans with at least 20% equity and Residential Investing Lending with at least 30% equity, or First Home Loans with at least 5% equity.

All rates are subject to change.

Run the numbers with these easy calculators.

Rates are one thing, but what do they mean for your finances? Use our calculators to work out what home ownership will mean for your finances.

Numbers not your thing? No problem, we love them. Let’s put our heads together and work out where you stand.

- How much home loan could I get for my current rent? Paying off your own home is a much more satisfying way to spend that rent money. Be my own landlord.

- How much can I borrow? The question everyone wants to know: how much house can I afford? Show me the money.

- How much are the repayments? Every payment will be chipping away at that loan. So how much will they be? It’s so worth it.

- How long will it take me to repay my loan? You can give yourself up to 30 years to pay off one of our home loans. Could you do it faster? I’ll bet I could.

Talk to us today about your first home dream.

Your first home loan is a big deal. If there’s anything you want to know, or if you want some advice on how to get a loan and how to set them up, give us a call. We’re happy to chat, and we’re on your side when it comes to getting that home.

Or if you’re ready to go, start your application online. You can save it and come back to it any time.

Important information about home loans.

- See all of our current interest rates for First Home Loans.

- First Home Loan lending and eligibility criteria apply. Our Standard Contract Terms and any applicable credit fees and charges that also apply are available online, from any branch of SBS Bank, or by calling us on 0800 727 2265.

- The information on this page does not take into account your individual circumstances and is not personalised financial advice. You should seek financial advice before you make any decision to open an account.