Jump to:

Jump to:

SBS Mobile banking app Getting started Resetting your app PIN How-to guide videos Security FAQsEverything you need, wherever you are.

The SBS Mobile banking app lets you do pretty much everything you need to do when it comes to your banking. That includes:

- Check the balances of your accounts, credit card, loans and investments.

- Transfer funds between accounts.

- Make payments to other people and businesses.

- Set up automatic payments.

- Manage your term investments.

- Link to our website to open new accounts and term investments.

- Reset your online banking password.

Going mobile is easy.

If you already use SBS Bank Internet Banking, it’s easy to get started with Mobile banking.

Check your Internet Banking profile to make sure that you’ve supplied the number for the mobile you’ll be using for the app. We’ll need that later to confirm your identity.

Start by downloading the SBS Bank Mobile Banking app onto your iPhone or Android smart phone:![]()

![]()

Then it’s step-by-step easy:

- Open the App and select ‘Register’.

- Accept the Terms and Conditions.

- Enter your member number and Internet Banking password, just as you do when you log on to Internet Banking.

- The app will ask you for a special code, which we’ll send to your mobile number by text message. It should arrive within a few seconds.

- Enter the special code and select ‘Continue’.

- Choose a 5-digit security PIN that you can use to access the mobile app.

And you’re done! All your accounts and cards will already be loaded. You can take the tutorials, or just have a browse.

Forgotten your mobile app PIN? It’s easy to reset.

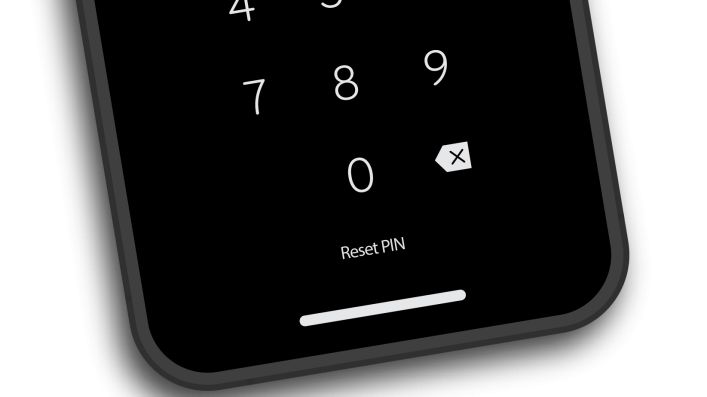

Open the SBS Mobile app, and look for the “Reset PIN” button at the bottom of the screen. (If you have Face ID on, just cover the camera to avoid logging in automatically.)

The app will then ask for your Internet Banking log in details to confirm it’s really you.

You can then choose a new PIN. This needs to be a new PIN that you haven’t used in the last two years.

Security and privacy on your mobile.

Keeping your banking and personal details safe on your mobile is important to you and to us.

For information about how we keep your mobile secure and what you can do as well, see our FAQs below, our Online Banking page and our Security page.

For more information on Privacy, see our Privacy Statement in our General Terms and Conditions.