The Kāinga Ora First Home Loan.

There’s no better feeling than getting the keys to your very first home. You can make your mark and fulfil your dreams for the future. SBS Bank is a First Home Loan lender. The First Home Loan, supported by Kāinga Ora – Homes and Communities, is an initiative to make access to home ownership even easier for everyday New Zealanders.

We also have some great home loan options for our standard residential lending if you don't qualify for the Kāinga Ora – Homes and Communities assistance so give the team a call and we can start talking about getting you into your first home. For more general background information on how residential home loans work, please visit our residential lending page.

First Home Loan features

- You can borrow up to 95% of property value – that means a deposit of only 5%.

- To be eligible you must have maximum total income of:

- $95,000 for individuals without dependents,

- $150,000 for individuals with dependents, or

- $150,000 for joint borrowers (two or more). - This type of loan is for owner-occupied homes only.

- This needs to be the only property you own.

- This type of loan does not offer a revolving credit facility, overdraft or interest only options.

- 1.20% FHL Premium Fee Applies.

- House price caps no longer apply to First Home Loans

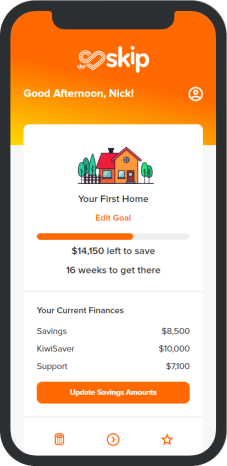

SKIP to the front of the line.

SBS SKIP is a mobile experience to help aspiring first home buyers prepare to get on the property ladder. It can estimate your eligibility for the First Home Loan scheme so you can see the impact on your first home goal.

On your laptop? Scan this code with your mobile to open Skip.

Talk to us today about your first home dream.

Your first home loan is a big deal. If there’s anything you want to know, or if you want some advice on how to get a loan and how to set them up, give us a call. We’re happy to chat, and we’re on your side when it comes to getting that home.

Or if you’re ready to go, start your application online. You can save it and come back to it any time.

Important information about home loans.

- See all of our current interest rates for First Home Loans.

- First Home Loan lending and eligibility criteria apply. Our Standard Contract Terms and any applicable credit fees and charges that also apply are available online, from any branch of SBS Bank, or by calling us on 0800 727 2265.

- The information on this page does not take into account your individual circumstances and is not personalised financial advice. You should seek financial advice before you make any decision to open an account.