The SBS FirstHome Combo at a glance.

Important Information

First Home Loan lending and eligibility criteria apply. Our Standard Contract Terms and any applicable credit fees and charges that also apply are available online, from any branch of SBS Bank, or by calling us on 0800 727 2265.

- A discount off our fixed 12-month interest rate for the first year.

Spend your savings on making your new home perfect. So many options. - $2,000 cash back in your hand.

Once your home loan is settled, we’ll give you $2,000 to spend on anything you like. Pay day. - $1,000 toward your new home’s insurance.

We’ll pay for $1,000 of your SBS Insurance home policies. That’s a saving. - $1,000 back into your SBS Wealth KiwiSaver Scheme account.

Your KiwiSaver account usually takes a hit with a first home. Have $1,000 to put back. Uncrack that nest egg.

An exclusive interest rate for first home buyers.

We’ll help you afford that first year of your first home.

We’ll give you a discount off our already sharp one year special fixed interest rate.

If you’re building, we can give you a very competitive floating rate.

Want to check our other home loan interest rates? They’re all here.

$2,000 of cold hard cash.

Important information

You will need to keep your loan with SBS Bank for at least four years. If you move your lending or repay it within four years, we will recover a portion of this payment.

We’ll give you $2,000 to help you with the costs of buying your first home. It will help make moving in just a little easier.

You automatically qualify for the $2,000 cash contribution when you use an SBS home loan for your first home. We’ll pay it into your account when you draw down your loan.

$1,000 home insurance.

Important information

If you cancel your policies within 12 months, we may recover all of this payment.

The last thing you want is for anything to happen to your new home. To help protect your home and your things, we’ll give you $1,000 to help pay for your first year’s premiums with SBS Insurance.

You just have to take out House and Contents insurance policies with SBS Insurance when you draw down your home loan, and keep them in place for at least 12 months.

House and Contents insurance policies are arranged by SBS Insurance (a subsidiary of SBS Bank) and underwritten by a third-party provider. SBS Insurance’s standard eligibility and underwriting criteria along with standard policy terms and conditions apply. You can ask for a copy of the relevant policy document from SBS Insurance by calling 0800 002 002.

A $1,000 top-up for your SBS Wealth KiwiSaver Scheme account balance.

Important information

If you transfer to another KiwiSaver scheme within 12 months, we may recover all of this payment. Standard eligibility criteria and investment terms and conditions apply. The issuer of the Scheme is SBS Wealth Limited (a subsidiary of SBS Bank). The current Product Disclosure Statement for the Scheme is available on request and free of charge from any branch SBS Bank or at SBS Wealth KiwiSaver Scheme.

We’ll give your SBS Wealth KiwiSaver Scheme account a $1000 top-up when it probably needs it most. Your KiwiSaver account is probably feeling a little empty if it helped you get into your new home.

When you draw down your loan we'll put a total of $1,000 back into your SBS Wealth KiwiSaver Scheme account to help get those savings started again. (If you have a joint loan, you share the $1,000 between you.).

You need to either be a member of the SBS Wealth KiwiSaver Scheme, or have successfully applied to join.

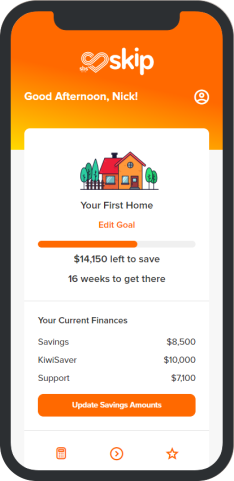

Earn even more cash back with Skip.

SBS SKIP is our mobile web tool that helps you prepare for your first home. It helps you save, checks if you’re eligible for grants, and even lets you earn $KIP Dollars that can turn into up to $2,000 when you take out an SBS loan for your home loan.

On your laptop? Scan this code with your mobile to open Skip.

Talk to us today about your first home dream.

Your first home loan is a big deal. If there’s anything you want to know, or if you want some advice on how to get a loan and how to set them up, give us a call. We’re happy to chat, and we’re on your side when it comes to getting that home.

Or if you’re ready to go, start your application online. You can save it and come back to it any time.

Important information about home loans.

- See all of our current interest rates for First Home Loans.

- First Home Loan lending and eligibility criteria apply. Our Standard Contract Terms and any applicable credit fees and charges that also apply are available online, from any branch of SBS Bank, or by calling us on 0800 727 2265.

- The information on this page does not take into account your individual circumstances and is not personalised financial advice. You should seek financial advice before you make any decision to open an account.